The essence of the QE2 policy was to increase the money supply by purchasing longer –term securities (government debt, mortgages, commercial loans) rather that targeting short-term interest rates. By doing this the Fed would “inject” money into the banking system, increasing the amount of reserves held by commercial banks. In theory this would give the banks increased liquidity and the ability to lend more, thereby stimulating growth in the economy.

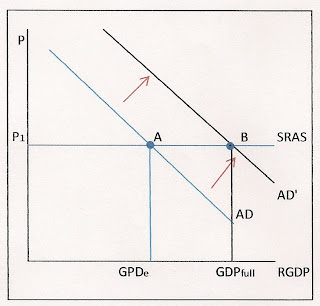

In theory, since banks receive little interest from holding reserves, the money injected by QE2 would incentivize the banks to lend out more money to households and businesses in order to earn a higher rate of return. This increase in the supply of money would shift the aggregate demand curve out to AD’. The new money shifts the AD curve because it is assumed that household borrowing and consumption will increase due to the increase in funds the banks are holding in reserve. Since prices are “sticky” in the short-run this increase in consumer lending and consumption will move the economy toward full employment as shown the graph above.

The issue with this policy is that an increase in aggregate demand, due to the increase in supply of money, will begin to start pushing up prices due to the increase in overall demand. As prices rise, output gradually returns to its original rate, and the economy moves from point B to point C as illustrated on the graph below.

At point C output is back at the original level of GDPe but now at price level P2. At this new level consumers are worse off than before the increase in the money supply because they are now paying more for a basket of goods than they were before .In the short-run the economy would grow but would eventually return to its original level in the long-run resulting in inflation.

Prior to QE2 the Fed has been driving down long term interest rates in order to stimulate growth. Rep. Pence’s issue with this policy is that for the first 18 months this mandate (lowering of had not worked; which led to QE2. With QE2 the Fed will purchase $600 billion in Treasury’s over the next eight months. With that, it has been hypothesized that the influx of money, coupled with the lower rates should help the U.S. economy grow modestly.

Rep. Pence disagrees with the notion that QE2 will prevent inflation. He wants to change the legislation which requires the Fed to balance both employment and inflation and focus strictly on price stability. His concerns center on the fact that the Fed increasing the money supply will lead to inflation, not economic growth in the long run, which would lead to financial instability.

Pence’s argument asserts that if the Fed does not increase the money supply to stimulate growth in the economy prices will naturally fall back to a toward the level they once were at GDPfull. If the Fed were to leave the money supply at its current level, or even reduce the amount in circulation along with raising interest rates, this path could potentially lower the rate at which prices are rising. Even though price stabilization may not bring prices down to their former levels, he contends that it would reduce the rate at which they rise to a more sustainable level, curbing inflation in the process. By not increasing the money supply and/or increasing the interest rates consumer demand would drop toward a level near P1. As demand decreases prices will begin to fall. As they fall, the quantity demanded at each lower price level will begin to increase. This increase in quantity demanded will shift the SRAS curve to SRAS’; increasing U.S. economic output toward the level of full employment to point D at P3, all without increasing the money supply and placing undue inflationary pressure on the economy.

http://blogs.wsj.com/economics/2010/11/15/gops-pence-calls-for-fed-to-drop-focus-on-employment/

1 comment:

Your analysis is a macro analysis, given the use of aggregate demand.

What might your analysis look like if you took a micro point of view? The macro model seems to assume the increased money supply will be spread evenly across all economic actors. But, if you think about this from a micro perspective, does this seem likely? Or, would you want to assume that the increased money goes only into a certain few pockets in the economy?

Post a Comment