December 17, 2010

Price Shopping with Phone

December 16, 2010

Chinese Iphone Made in America

When Will China Overtake the U.S.?

December 15, 2010

Japan Outsourcing to China

December 1, 2010

Ireland's Minimum Wage

Eamon Gilmore argues that this reduction of the minimum wage will result in more borrowing from banks. Brian Cowen says that “the whole idea is to keep as many people in work at a time when the trading environment is very difficult.” So who is right? As we all know a minimum wage results in employers having to pay more than the market equilibrium price for labor. This results in employers must reduce the amount of labor they employ so there becomes a surplus of labor. Ireland has above a 17% unemployment rate. What Eamon Gilmore is concerned about is that this reduction in wages will cause a economic strain on the poor and people earning the minimum wage which will result in these people borrowing more money. This is not the case, the reduction of the minimum wage means that it moves the price of labor closer to the equilibrium. It will reduce the surplus of labor. This means that it will not only help reduce the unemployment rate which reduces the amount of people drawing unemployment benefits from the government, saving the Irish government money which it desperately needs. But it also means that companies can offer more hours to employees. So across the board anyone who is affected by this decrease of minimum wage is better off. They can either find a job or work more and earn more money. So this increase in pay means that they will borrow less money to pay their bills and maybe even begin to pay back the loans they currently have.

Web Site: http://businessandleadership.com/economy/item/27036-cowen-defends-minimum-wage/

Are Intellectual Property Laws Harmful?

Intellectual property laws have long been the backbone of innovation. Intellectual properties are the so-called ‘creations of the mind;’ that is, inventions, artistic works, trademarks, copyrights etc. In essence, then, intellectual property rights laws serve to grant the owner or creator of the invention/idea/patent etc. exclusive rights for using and benefiting from such intangible goods. But are these laws right? Let us take a look from an economics standpoint.

On one hand, it can be argued that intellectual property laws are a necessity in promoting innovation and creation in the first place. Without intellectual property laws to protect his patents, copyrights and trademarks, a creator could potentially lose his ideas to others who find them appealing. What motivation – save for purely altruistic motive or creative passion - would a designer have to invest his time, his brainpower, and potentially millions if not billions of dollars into something that he may ultimately reap no reward from? Assuming the invention is any good, there would be massive demand for an invention at 0 cost. In this case, though, it would stand to reason that the producer would be unmotivated to produce if he won’t gain any benefit, and ultimately, the good would go unproduced. This extreme case of excess demand thwarts the idea of abolishing intellectual property laws, and the notion surely is that of a socialist mindset that everyone must share equally.

However, not everyone buys this logic. The other side of the argument cries that intellectual property laws dissuade competition, reduce maximum innovation, and lead to monopolies. This is the position the article’s author seems to take. He appeals that, especially in biotechnology and medication industries, that vital information is being purposefully restricted. It is not entering the marketplace at all, so not only can nobody compete, those who could benefit from the goods cannot and people are dying as a result. Furthermore, as information is often hoarded rather than allowed to enter the marketplace, free market competition is not allowed to thrive. In the instances of software rights and other goods being shared (eg. open source software), the industries boon on the free ability of different producers to share ideas and create better products. This not only benefits the consumer, but the producers are selling more, and it stands as a triumph of free market capitalism and is hardly a ‘socialistic mindset.’ Lastly, from intellectual property laws arise monopolies. The government empowering the bearers of intellectual property with unlimited control of their goods – no matter how much or how little of it is used – allows certain businesses to conquer entire industries (eg. Microsoft). Good ideas will flourish whether or not the government is sticking its nose in the business, and everyone would be better off if intellectual property laws were simply abolished.

This issue is certainly a complex one with strong points for both sides. Would abolishing intellectual property rights be a boost to a free market system and be better for everyone as the author and other proponents of this idea suggest? Or is protecting the intellectual property of innovators the only way to encourage production? What do you think?

What the Deep-Sea Drilling Moratorium Really Caused

The moratorium will cause a decrease in supply as big oil companies will not be able to drill as much as they normally could. Due to the shift to the left of the supply curve, the equilibrium price will go up which will effect consumers all around the world. I believe most people in the world want gas prices as low as possible so why is Obama doing this? The reason Obama introduced the moratorium on deep-sea drilling was so that United States citizens felt like the government was responding to the oil spill adequately. Instead what they are doing is raising prices of gas which is one of the biggest issues that Americans have today.

The moratorium also decreased jobs for Americans as these rigs employed thousands of Americans. So instead of repairing the government’s image like the Obama administration wanted, they put a lot of people on the Gulf Coast out of work and raised gasoline prices.

Even though Obama did lift the moratorium in mid-October the amount of crude oil that the companies could have drilled is permanently reduced. Before the moratorium, oil rigs were already drilling but after they were forced to move to other places around the world to drill. The oil rigs are not going to come back to Alaska, etc. because they already spent millions of dollars to get to other places to drill. I cannot see a decrease in gas prices coming anytime in the near future but we’ll see.

November 30, 2010

Black Friday Externalities

According to www.carolinalive.com, a leading online state news article, explains how in South Carolina, for a third year in a row, has made hand guns, rifles, and shotguns tax free within the state during Black Friday and the following Saturday. This event is called the 2nd Amendment Sales tax and is the only tax write-off during that holiday that is shockingly designated only for firearms. By having tax free gun purchases, it has considerably raised the demand of firearms during that short weekend, considering the nearly hundreds of dollars saved without a tax upon the purchases and an increase of revenue for the local gun shops in South Carolina. Though shoppers may have felt a rush of savings through the purchase of firearms, there will be externalities that may occur. Even with the costs of obtaining firearms to be much lower than other parts of the year, many would consider this frugal event to be questionable, seeing that there will be an influx of legal but dangerous weaponry in the hands of consumers. With an increase of firearms on the there will be an assumption that crimes and/or deaths may increase within the state but on the other hand may even raise profits for local gun shops in the state of South Carolina and aid the state locally especially in the current economic depression.

To veteran gun owners and newly gun toting citizens alike, this tax free exception on firearms may seem like a valuable opportunity to obtain a firearm during this current economic downturn but ultimately consequences may arise with externalities (rise of crime and deaths) considering the seemingly never ending debate with firearms.

Website Link: http://www.carolinalive.com/news/story.aspx?id=546598

Uncle Sam, quit regulating Santa!

While it is true that "toys are safer than ever" this regulation will increase the costs of the firm. Looking at a basic supply demand diagram, from the original equilibrium point an increase in regulation will increase cost for the firm (for things such as hiring new designers and purchasing new manufacturing equipment). The firm’s quantity supplied will decrease. Eventually, because the regulation affects all toy firms, the overall price for holiday consumers will increase. The increase in regulation will make it harder for producers and consumers alike. Due to the increase in price, consumers have a smaller budget line, in effect less money. This regulation is making it harder on both consumers and producers in this recession. It would be a better idea to forgo regulation or at least not add more regulation as they have done in the past. This option would be better for both consumer and producer.

The buyer still needs to deal with safety concerns. Miss. Kerr seems to think that consumers can not make good purchasing decisions without regulation. Consumers wish to maximize their utility, something they are probably not achieving if their child chokes on a toy. Consumers will purchase most merchandise from the firm who maximizes consumer utility best. The firms who are the most carful in producing toys will receive the most business.

At the end of Miss. Kerr’s article, she talks about a company that complied with the government regulation and still had a child choke on a toy. This happened even when the toy meet every single regulation standard. While Miss. Kerr seems to advocate increasing regulation, this is unnecessary. The company in the example recalled all the toys, and quickly fixed the problem. The firm was doing its best to make consumers happy. Accidents will always occur, but the firm that fixes these mistakes and maximizes consumer utility will stand in the end. If the toy market is a perfectly competitive market, other manufactures will be forced to do the same or eventually drop out of the market.

Ethanol: Is it the Right Thing

The demand curve shifted to the right due to the increased demand which led to an equilibrium shift from E1 to E2. E2 implicates a higher equilibrium price. In developing countries like Mexico, prices for corn skyrocketed and consumers in these countries are unable to pay a higher price. In 2008, the price of corn increased 110 percent from where it was nine months prior. With demand increasing by so much, a lot more supply is needed and many United States farmers are unable to keep up with the increase. If we want to reduce this threat to developing countries, we need to either use different products to create the ethanol like wheat for example. Doing this will help out these developing countries that have been hurt due to the corn price increase so that these people will not be struggling anymore.

There's no harm in a "living wage", oh really?

What IT Resellers Mean to the Economy

Recently I read another article in the Denver Business Journal relating to IT resales and their effect on the current economy. IT Resale Company’s buy used computers, servers, and other business technology, and then prepare them for resale. According to the article many economic professionals see this as an indicator that the economy has a long way to go before it can reach a full recovery. During the hardest part of the recession business’s had to downsize but decided to try keeping their IT equipment because they would need it all when they were able to hire everyone back. Eventually, these companies started to sell their equipment to IT liquidators after three or so years of layoffs and other business failures due to a failing economy. As evidence to this statement the article stated that one company, IT Liquidators, purchased just over 6,200 pieces of IT equipment in 2007 and over 29,900 pieces in 2010. These numbers suggest that companies did not hire back workers and eventually more and more company’s started selling their old IT equipment that they weren’t using. The article also stated that IT equipment drops 3-5% in value per a month so waiting so long was very costly for the selling company’s. The rest of this article will examine how even though IT resellers are greatly increasing their business, it’s not helping to improve the economy.

At the beginning of the semester we learned how demand was the quantity of goods or services that a consumer is willing to purchase at each price. Demand can be viewed from both sides in this situation. First, there is a high demand for old IT equipment from failing businesses by IT resellers because it is a highly successful business right now. In fact the article stated that during the recession IT Liquidators business has quadrupled. Also, there is the higher demand for used IT equipment for businesses that have began to grow again. The article stated that survival for most companies these days starts with being more cost-conscious. This has led to businesses being more receptive to buying used IT equipment. Another fact is that businesses aren’t willing to go out and buy the more expensive upgraded gear unless there will be an immediate return on their investment.

IT equipment resellers are not the only companies in the field who have seen an increase in demand for their commodities. Being more cost-conscious has also led some companies to repair what IT equipment they have currently rather than buy new or used equipment. The article mentioned that Action Computer’s repair business has increased 40% in the past year alone. As I mentioned earlier even though business has drastically improved for IT equipment resellers and IT equipment repairing companies, it’s a bad sign for the overall improvement of the economy. This suggests that the reason so many companies are selling their IT equipment is because they’re downsizing or going out of business which is the exact opposite of what is necessary for the economy to start growing again.

Sources:

Denver Business Journal November 26- December 2, 2010 “IT resale’s good, but that’s bad for economy”

Left and Right: Down With Ethanol Subsidies

In recent years, the US government has been subsidizing the ethanol industry, giving them tax breaks that have stimulated growth and production of ethanol in the United States. The underlying justification of subsidizing domestic ethanol production is that it strengthens US energy independence. But at what price?

According to this article, many groups, conservatives and liberals alike, disapprove of the current subsidies of this industry. Conservatives want to cut the subsidy program because they see it as a handout to private interest, and cutting it would reduce federal spending. Environmentalists feel that ethanol has no real effect on greenhouse emissions. Liberals feel the benefits of using corn as fuel are marginal, and they think that the subsidy of ethanol (which is corn-based) is driving up food prices. 1

While this article addresses some very important social issues, it really does not address the economic issues that can result from an industry subsidy such as this. Considering the market for ethanol, when the government has subsidized ethanol production, the supply curve for ethanol surely shifted outward, resulting in a larger quantity being supplied, at a lower cost. The impact of the subsidy is lower prices for consumers with higher prices received by producers; this results in both a surplus for consumers and a surplus for producers. While lower prices for consumers is nice, it is a direct result of the government subsidizing ethanol production, so while consumers may enjoy paying a lower price, they inevitably pay for this through their own taxes.

The total figure by which the ethanol industry is being subsidized by the US government is about $6.5 billion per year. According to a study by the Global Subsidies Initiative, if ethanol subsidies were eliminated, demand for ethanol would fall, resulting in corn commodity prices declining by $.30 per bushel. As the price of corn falls, other farm subsidy programs would go into effect, costing the government about $.57 billion per year. 2 The Renewable Fuels Association believes that eliminating the ethanol subsidy would result in a loss of $3 billion in net revenue of federal taxes.1

So, $6.5 billion per year in subsidies could be saved if the program were eliminated, but there would be an additional burden of $.57 billion on other farm subsidy programs. So eliminating the program would save $5.9 billion per year. I did not include the loss of net tax revenue into this calculation because this tax is not a benefit, but a transfer.

Based on preliminary observation, it appears that liberals, conservatives, and environmentalists may be on to something; whether they know it or not.

1 http://blogs.wsj.com/washwire/2010/11/30/left-and-right-down-with-ethanol-subsidies/

Really? A Monopoly?

“Google holds a dominant position on the advertising market related to online searches,” the French authority concluded. “Its search engine enjoys a wide popularity and currently totals around 90 percent of the Web searches made in France. Moreover, there are strong barriers to entry for this activity.” In class, we asked what explains the presence of a monopoly. We concluded that we must assume there are barriers to entry so that the one supplier remains the only supplier. We also asked where the barriers to entry would come from, and concluded that barriers exist because of some kind of public policy or government. We also said that if we see a monopoly without government backing, the monopoly would not survive over time. I do not see any of this in this particular issue. There may be some barriers to entry with online advertising, and I would like to know exactly what strong barriers the French Authority are referring to. (I tried to look it up on their website, but it did not say). The point is there is currently no public policy or government declaring that Google must be the only supplier of online advertising. The Authority claimed that 90 percent of the web searches in France are through Google. This must mean that 10 percent of web searches are through another source. This indicates that Google is not the only supplier of web searches and online advertising, but that there are others in the industry. Therefore, Google is not the only supplier, and is not a true monopoly. However, they clearly dominate the market at this time in online advertising. Google has been around and dominating the market for some time now. If we do consider Google as a monopoly, and it does not have government backing, then we would expect the monopoly not to persist over time. So how is it that Google still exists?

The author says, “Once a company comes to understand that being too successful may be bad for its future, it is really hard to stay on the cutting edge.” Here, I think the author is mistaken. Just because Google is ahead of its competitors and is successful, does not mean that it will be bad for them in the future. For a true monopoly, I’m not sure if there is such thing as being too successful. After all, we would probably consider that a monopoly is “too successful” in the first place since they are already the only supplier. As they become successful and make a profit, they will remain in the current industry as there are barriers to entry and this does not necessarily mean it will be bad for their future as the author implies. It actually may have more positive signs for the future rather than negative signs.

Not only is the author wrong in evaluating the situation with some of his comments, I think that the French Competition Authority was wrong in the first place in determining whether or not Google is a true monopoly. I think Navx was scared for the future of their company and complained about Google to save their own butts. What do you think?

(Here is some important info from the article, so you don’t have to read it all - “Having determined Google has a monopoly, the agency ordered the company to resume offering its services to a French company called Navx, which sells a database to let drivers know where the French police are likely to have radar traps in operation. Google found Navx’s business distasteful — it is arguable that Navx’s customers use the product to help them act illegally with impunity — so last November, Google stopped doing business with Navx. As a result, those using search terms like “radar trap” in French could no longer learn of the company’s product and, a few clicks later, buy it. Navx complained to the French government, saying its sales had plunged and that as a result it was facing problems raising capital. On Wednesday, the authority ordered Google to resume selling ads to Navx and to produce clear policies on when advertisers would be turned down.”) hmmmmm.....

Perfect Competition

We can characterize them as in monopolistic competition especially if they are a farmer’s market because in that case, advertising creates brand loyalty. A firm would invest in more capital because the profits will be guaranteed in the long run for the firm. Because profit is zero in the long run, and we know these businesses are in the long run, how can it possibly make sense that they are experiencing higher profits?

http://www.komu.com/KOMU/d7e2017e-80ce-18b5-00fa-0004d8d229cb/5732a740-80ce-18b5-00b0-903481aee60e.html

November 27, 2010

Minimum Wage

I began by looking at the actual unemployment rates and teens and blacks are significantly higher than other categories. According to the BLS, teen unemployment stands at 27.1% and black unemployment at 15.7%...MUCH higher than the national average.

The arguments to explain this were most clearly articulated by Thomas Sowell, an economist at Stanford University. His arguments state that:

According to Sowell, when we legislate min. wage, we fail to account for the movement of real wages in the economy between levels of worker. By standardizing wage increases, policy makers and politicians stop looking at the evidence and escalate the wages of the lowest level of worker on a schedule without accounting for the wages of the experienced worker, which creates a disequilibrium in the wage structure.

The result of this situation and a min wage is that unskilled workers, statistically teens and blacks, are legislated to a wage that is relatively the same wage as a skilled worker. Thus, when firms choose to hire labor, they are faced with a labor market providing two levels of skill at the same cost. Facing that choice, firms will of course choose to hire an experienced worker over an inexperienced worker given the costs the firm incurs to train a new worker, clearly an inexperienced worker is a larger investment than an experienced one.

If there was no floor in place, inexperienced workers could bargain for a lower wage and obtain employment from firms who are, of course, seeking to maximize profits. These firms would be willing to hire more labor at a lower price and invest in their long term productivity by providing training. In addition, this would free up resources on the firms end for them to then invest in capital, thus in the long run, enabling them to provide even more jobs.

It seems to me there is a cyclical impact here in the unemployment cycle that min. wage negatively reinforces. It also occurs to me that the min. wage policies hurt those that they were intended to help, and I can't help but wonder why they are still a matter of public policy. Based on my readings in Prof. Eubanks other class, I can't help but think there must be either A) a special interest at work with something to gain from a min. wage or B) a political football for the politicians to use against the rationally ignorant public who is unaware of the negative economic impact of the policy.

Mo' Money, Mo' Money? How about No Mo' Money.

The essence of the QE2 policy was to increase the money supply by purchasing longer –term securities (government debt, mortgages, commercial loans) rather that targeting short-term interest rates. By doing this the Fed would “inject” money into the banking system, increasing the amount of reserves held by commercial banks. In theory this would give the banks increased liquidity and the ability to lend more, thereby stimulating growth in the economy.

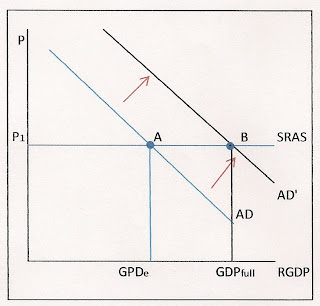

In theory, since banks receive little interest from holding reserves, the money injected by QE2 would incentivize the banks to lend out more money to households and businesses in order to earn a higher rate of return. This increase in the supply of money would shift the aggregate demand curve out to AD’. The new money shifts the AD curve because it is assumed that household borrowing and consumption will increase due to the increase in funds the banks are holding in reserve. Since prices are “sticky” in the short-run this increase in consumer lending and consumption will move the economy toward full employment as shown the graph above.

The issue with this policy is that an increase in aggregate demand, due to the increase in supply of money, will begin to start pushing up prices due to the increase in overall demand. As prices rise, output gradually returns to its original rate, and the economy moves from point B to point C as illustrated on the graph below.

At point C output is back at the original level of GDPe but now at price level P2. At this new level consumers are worse off than before the increase in the money supply because they are now paying more for a basket of goods than they were before .In the short-run the economy would grow but would eventually return to its original level in the long-run resulting in inflation.

Prior to QE2 the Fed has been driving down long term interest rates in order to stimulate growth. Rep. Pence’s issue with this policy is that for the first 18 months this mandate (lowering of had not worked; which led to QE2. With QE2 the Fed will purchase $600 billion in Treasury’s over the next eight months. With that, it has been hypothesized that the influx of money, coupled with the lower rates should help the U.S. economy grow modestly.

Rep. Pence disagrees with the notion that QE2 will prevent inflation. He wants to change the legislation which requires the Fed to balance both employment and inflation and focus strictly on price stability. His concerns center on the fact that the Fed increasing the money supply will lead to inflation, not economic growth in the long run, which would lead to financial instability.

Pence’s argument asserts that if the Fed does not increase the money supply to stimulate growth in the economy prices will naturally fall back to a toward the level they once were at GDPfull. If the Fed were to leave the money supply at its current level, or even reduce the amount in circulation along with raising interest rates, this path could potentially lower the rate at which prices are rising. Even though price stabilization may not bring prices down to their former levels, he contends that it would reduce the rate at which they rise to a more sustainable level, curbing inflation in the process. By not increasing the money supply and/or increasing the interest rates consumer demand would drop toward a level near P1. As demand decreases prices will begin to fall. As they fall, the quantity demanded at each lower price level will begin to increase. This increase in quantity demanded will shift the SRAS curve to SRAS’; increasing U.S. economic output toward the level of full employment to point D at P3, all without increasing the money supply and placing undue inflationary pressure on the economy.

http://blogs.wsj.com/economics/2010/11/15/gops-pence-calls-for-fed-to-drop-focus-on-employment/